Page 21 - Annual Report 2023

P. 21

60,000

55,000

50,000

45,000

Load (MW)

40,000

35,000

30,000

25,000

20,000

533

267

1

799

3459

3193

2927

4257

3991

3725

2661

1597

1331

1065

2395

2129

1863

Hour 4523 4789 5055 5321 5587 5853 6119 6385 6651 6917 7183 7449 7715 7981 8247 8513

Figure 15: Load Duration Curve in the Intended Fiscal Year Power Market Annual Report 1401 17

Power Market Annual Report 1401 21

9. Percentage of Energy Supply by various Trade

9. Percentage of Energy Supply by Various Mechanisms 7. Transmission Cost

Mechanisms

1

According to the pie-chart in figure 16, spot market trades account for nearly 88% of the annual Since RECs are the owners of the transmission system in IREMA, the transmission cost is paid

According to the pie-chart in figure 16, spot market trades account for nearly 88%

electricity generation which is similar to the last year. to them to remunerate their costs. According to Figure 14, the highest amount of transmission

of the annual electricity generation which is similar to the last year.

cost was recorded in spring while due to the reduction of cross-border exchanges the lowest

amount was observed in summer time.

Energy Exchange

Spot Market 2% 35,000

88%

30,000

Bilateral Contract 25,000

10% 20,000

Billion Rials 15,000

Figure 16: Percentage of Energy Supply by Various Mechanisms

10,000

10. Demand and Total Cost

10. Demand and Total Cost 5,000

Totally 346,500 GWh of electrical energy was traded in the spot market. EDCs

Totally 346,500 GWh of electrical energy was traded in the spot market. 1 ‐ Spring Summer Fall Winter

and RECs are the major active buyers within the spot market.

2

Figure 14: Total Transmission Cost in the Intended Fiscal Year

110,000

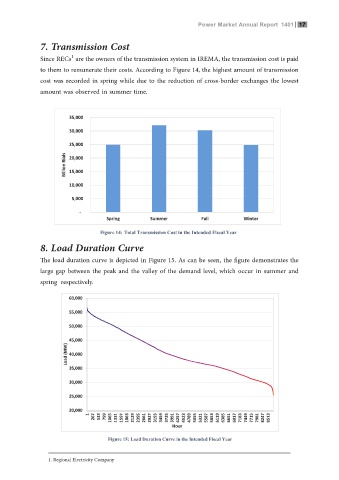

8. Load Duration Curve

100,000 8. Load Duration Curve

90,000 The load duration curve is depicted in Figure 15. As can be seen, the figure demonstrates the

The load duration curve is shown depicted in the fFigure 15. This is defined as

80,000 16 the relation between the load and time in which the ordinates representing the

70,000 large gap between the peak and the valley of the demand level, which occur in summer and

load, plotted in a descending order. As can be seen, Tthe figure demonstrates the

spring respectively.

GWh 60,000 large gap between the peak and the valley of the demand level, which occur in

summer and spring respectively.

50,000

40,000 60,000

30,000 55,000

20,000

50,000

10,000

0 45,000

Spring Summer Fall Winter

Load (MW) 40,000

Figure 17: Total Energy Consumption ﺩﺭﺍﺩ ﻖﺑﺎﻁﺗ 6 ﻝﮑﺷ ﺎﺑ یﺩﺎﻳﺯ ﻩﺯﺍﺩﻧﺍ ﺎﺗ ﺎﺗﻬﻳﺩﺑ : Commented [IR5]

Figure 17: Total Energy Consumption

35,000

Figure 18 shows that EDCs had basically the greatest share in the total payments یﺎﻬﻠﮑﺷ ﻩﺭﺎﻣﺷ ﻼﺻﺍ ﺏﻗﺍﺭﻣ ﻑﺫﺣ ﺯﺍ ﺩﻌﺑ . ﺩﻭﺷ ﻑﺫﺣ ﺕﺳﺍ ﺭﺗﻬﺑ ﻭ

Figure 18 shows that EDCs had basically the greatest share in the total payments which increased ﺩﻳﺷﺎﺑ ﻥﺗﻣ ﺭﺩ ﺎﻬﻧﺁ ﻉﺎﺟﺭﺍ ﻭ یﺩﻌﺑ

which increased remarkably in summer to 111,829 Billion Rials and then

30,000

remarkably in summer to 111,829 Billion Rials and then declined to 56,803 Billion Rials in winter. 25,000

declined to 56,803 Billion Rials in winter.

160,000 20,000

1

140,000 267 533 799 1065 1331 1597 1863 2129 2395 2661 2927 3193 3459 3725 3991 4257 4523 4789 5055 5321 5587 5853 6119 6385 6651 6917 7183 7449 7715 7981 8247 8513

Hour

120,000 Figure 15: Load Duration Curve in the Intended Fiscal Year

100,000

Billion Rials 80,000 1. Regional Electricity Company

9. Percentage of Energy Supply by various Trade

Mechanisms

60,000

15

40,000 According to the pie-chart in figure 16, spot market trades account for nearly 88%

20,000 of the annual electricity generation which is similar to the last year.

0

Spring Summer Fall Winter

EDC 74,331 111,829 68,737 56,803

REC&TavanirCo 27,654 34,382 33,371 24,832 Energy Exchange

Spot Market 2%

88%

Figure 18: Buyer's Total Cost Payment in Spot Market

Bilateral Contract

10%

Figure 16: Percentage of Energy Supply by Various Mechanisms

1 Electricity Distribution Company

2 Regional Electricity Company

17

16